We don't have a big budget with which to purchase all these gifts and we don't generally purchase big ticket items but everyone is usually pretty happy with what they receive. Let me share some of my tips and techniques that I have used to accomplish this feat each year.

- Keep a gift notebook. I use a plain old spiral notebook but you might like to set up something in your phone or computer. I allot a page to each family member and I pay close attention to anything they say that they would like to get. I write this info on their page and keep my eyes open all year for these items to give to them for Christmas or birthday gifts.

- Use the Kohl's or other store gift cards that come in the mail to you. I received three $10.00 Kohl's gift cards in my mailbox. The first one I used to help purchase some lovely Melissa & Doug puzzles for my grandsons. Kohl's had the puzzles on sale at 20% off their regular price and I applied the $10.00 gift card to the purchase and got two nice wooden puzzles valued at $27.00 for a total of $11.50. The second $10.00 card was used to purchase a $56.00 sweater for my youngest son for only $11.99. The sweater was on sale for $21.99 and I applied the $10.00 card towards it, making it an amazing deal. My son was delighted with his sweater and wore it to his grandparents' house for Christmas. The third $10.00 gift card helped me to purchase $52.00 of items for only $17.99. I bought my older daughter a pair of Lauren Conrad leggings on sale for $9.99 (were $20.00) and I bought some very nice bath and body items for my son's girlfriend at 50% off the regular price, then applied the $10.00 card and went home very happy with my purchases. The young ladies were also very happy when they opened their gifts on Christmas Day. If you are keeping track, you will note that I purchased $135.00 of items for five people for only $41.48! That is nearly 70% off the original retail price of the items. Even on a very limited income, shopping this way allows me to stretch my precious dollars and bless my family.

- Watch for bargains all year: I have a spot in my closet where

I store items I bought on clearance for future events such as

birthdays and holidays. I purchased a plaque for my daughter's

boyfriend that said Man Cave. It was on clearance at Target for

$5.00 but was originally $12.00. Colin loves his man room so I knew

this would be a fun addition to his room. I saw it and purchased it

in March 2013 and held on to it until Christmas. When I see a sign

that says “Clearance” or see those wonderful orange clearance

tags, I make a beeline to that area and go through that section to

see if there are any items that would make great gifts.

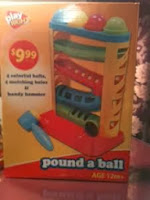

I bought this after Christmas last

year to save for my younger grandson.

I only paid $5.00 but I count it as a

$10.00 gift.

- Shop thrift stores: Yes, even for Christmas! Thrift stores are full of brand new and like new items. It is true that you cannot return the items that were purchased at thrift stores but don't let that discourage you from shopping there- you just need to know the person very well for whom you will be shopping to make this work. I have gotten many new items at my favorite thrift store that still have the retail tags attached. My thrift store runs a different daily special each day. A few weeks ago when I stopped in, the specials were: 50% off all books, puzzles, and bagged toys. I got six new condition board books for my younger grandson for $1.50, a new condition wooden puzzle for the same child for $1.00, and several amusing paperback books to tuck into stockings for 12 cents each! Earlier in the year, I bought a new 4-piece sushi serving set for $4.00 to give to my younger daughter.

At retail price, these books would have

cost me $13.00, but I paid 75 cents!

What little boy or girl wouldn't love this

puzzle for Christmas?

- Purchase memberships to certain stores to get discounts all year long: my youngest son has a memberships to Game Stop which enables him to get a 10% discount on purchases. He allowed me to use his discount to purchase items for my daughter's boyfriend for Christmas. I bought one game brand new and one game previously owned and saved 10% on the whole purchase.

- Many stores offer a bonus gift card for the purchase of a certain dollar amount of gift cards. Case in point: Half-Price books offered a $5.00 gift card good in January for each $25.00 gift card purchased in December. I had a lot of books on my list for Christmas gifts so when I went into the store, I bought gift cards, got my bonus gift cards to use in January, made my selections, and then used the gift cards I had just gotten to purchase my Christmas gifts. In January, I get to take $15.00 in bonus gift cards to go shopping for myself or get a head start on 2014 Christmas shopping.